The Art of Value Investing: Opportunities across Cycles

- M Manohar Rao

- Apr 14, 2025

- 5 min read

Tags: Wealth Management, Investment Lesson, Mutual Funds, Stock market, Budget, Finance, Investing, Personal Finance, Investment, Smart Beta Funds

Value investing is an investment strategy that involves picking stocks below their intrinsic or book value.

The intrinsic value is based on subjective reasoning and can subtly vary from person to person. The book value, on the other hand, is an audited figure and hence, more objective and easier to compare with the market price.

The undervaluation with regard to book value was popular from the 1950s till the end of the 20th century. This was because there was decent information arbitrage in an era where quarterly updates were not provided. One needed to be a shareholder to have access to annual reports. So, any investor having access to company management and annual reports could have an advantage over other investors. In the current scenario, there is a democratization of information, and the same information is available to all categories of investors. Thus, if any institution’s worth is trading below the book value, it can be assumed that many investors would have evaluated and given it a pass.

Hence, there is an increased focus on identifying the intrinsic value and focus on companies trading below the intrinsic worth. Interestingly, there is no single definition of intrinsic value. It usually depends on factors such as growth prospects, cash flows and quality of businesses.

Identifying good-quality stocks

The approach in the Large & Mid Cap Fund and Aggressive Hybrid Fund to value investing is a mix of identifying:

i) Good quality companies trading at below mean valuations

ii) Well-run cyclical companies and turnaround opportunities

iii) Growth-oriented Small Cap companies

Let’s discuss the strategy in detail.

1) Buying good quality stocks at below mean valuations: Every good quality stock has a valuation cycle that varies on a long-term timeframe based on changes in the business or management and other macro issues. If the company has a healthy long-term track record of growth, cash flow generation and RoCE, usually there is mean reversion and potential for alpha generation, if bought at the right valuations.

The following are instances of variation in valuation over 10 years for certain blue-chip/ well-established stocks:

In each of the cases above, we observe a huge deviation between the lowest and highest P/E during a 10-year period for four Large Cap index heavy weights. These companies have been the torchbearers for their sector in terms of growth, quality and best-in-class governance. During periods of underperformance, short-term concerns are often overemphasized. As a result, stocks remain under pressure until clear triggers emerge. This creates valuable opportunities for long-term investors.

The strategy predominantly focusses on stocks with good long-term track records trending below their mean valuations and then holding the stocks for a decent period of time.

2) Buying well-run cyclical companies: Cyclical companies are good candidates for a value investment style. They usually have different business cycles depending on the prices of the commodities and volumes of the key cyclical products. It has been observed that there is a strong correlation between the commodity companies and the underlying commodity they sell. When the price of the commodity is low, it is observed that the share prices follow suit and valuations, in terms of P/B, remain on the lower side.

Here’s a sample price chart of NMDC, one of the largest producers of iron ore, and the iron ore futures for reference:

As can be observed, there is a strong correlation between the price of iron ore and NMDC shares. During our selection process, we choose companies with a lower cost curve, low leverage and a strong track record of execution.

3) Focus on growth-oriented Small and Mid-Cap companies (SMIDs): Although today the camp is divided into growth and value, there is common ground as both the categories of investors aim to select growth companies at reasonable valuations. And since most of the top 200 companies have relatively high valuations, it becomes challenging for value-oriented investors.

However, for Small Caps and select Mid-Cap stocks, there remains the opportunity to identify growth-oriented stocks as they may not be well-tracked by investors at large. We seek to identify such stocks and aim to benefit from their growth. We lay a high bar on quality while evaluating such stocks. We look at leaders in the segments who operate with a strong track record of execution.

Where is value in the current markets?

The valuations of the indices, especially the broader indices, have gone above the board in the last five years. This has happened on the back of strong liquidity from both domestic investors and Foreign Institutional Investors (FIIs). India’s strong outlook on earnings, coupled with political and economic stability, remain the key drivers of growth.

While the BSE 100 is currently trading at ~18% premium to the long-term average, it is significantly higher for Mid and Small-Cap indices. The surge in valuations is being observed across the sectors. However, in some cases, the valuation of the sector being premium to a three or five-year average may have a negative outlook, while in other cases there could be a positive outlook too. Therefore, one must understand the context of how the sector has evolved.

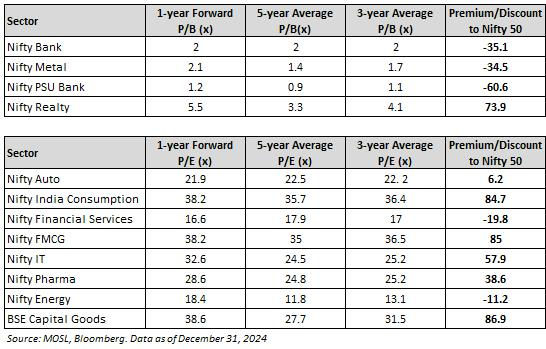

Here’s the table of the valuation of sectors as compared with the long-term history:

Sector-specific opportunities and challenges

Placed below is our view on sectors in which we find comfort/ apply caution:

Conclusion: A disciplined value approach

Our disciplined approach is to look for quality stocks at reasonable valuations and escape from value traps by avoiding cheap companies that may look attractive on valuations but may suffer from low RoCEs, poor profit margins or governance-related issues.

Irrespective of market cycles, we believe there are opportunities to identify good-quality stocks or sectors trending much below their long-term. We rigorously look for such opportunities and endeavor to hold for a decent period to benefit from the valuation mismatch. We are also cognizant of the overvaluation of the opportunities identified. Further, we are disciplined to exit or trim the positions and scan for new ideas in the market across the cycles.

Disclaimer:

The information set out above is included for general information purposes only and is not exhaustive and does not constitute legal or tax advice. All complaints regarding Mutual Fund can be directed towards visit www.scores.gov.in (SEBI SCORES portal). Readers are requested to make informed investment decisions and consult Chaitanya Financial Consultants – 9000628943 / mfd.mmr@gmail.com to determine the financial implications with respect to investing in Mutual Funds.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Join WhatsApp group for better and personalised communication regarding investment lessons, advice and help.

Note: Members of our WhatsApp group will enjoy lifetime free investment advice and will not be charged any consultation fee for mutual fund investments.

Support My Mission – Your Small Contribution Matters!

I am passionate about sharing financial knowledge and guiding people toward financial independence. Through my articles, I strive to provide valuable insights that can help you make smarter investment decisions and secure your future.

If my work has added value to your financial journey, I would truly appreciate your support. A small contribution from you—whatever amount you feel is right—will go a long way in motivating me to continue creating high-quality content.

💰 You can support me via:

✔ Paytm / Google Pay / Amazon Pay: 9000628943

✔ PayPal: manomatt@rediffmail.com

Every small payment is not just financial support—it’s an encouragement that fuels my passion for educating and empowering others. Thank you for being a part of this journey! 🙏

Here’s your chance to earn extra money effortlessly. Simply refer someone to invest in any mutual fund scheme, and as soon as they invest, you'll receive ₹100 - ₹200 instantly in your bank account via Paytm or PhonePay. Start referring and start earning today!

Comments