SIP at Rs. 500

- M Manohar Rao

- Jun 3, 2025

- 7 min read

Tags: Wealth Management, Investment Lesson, Mutual Funds, Stock market, Budget, Finance, Investing, Personal Finance, Investment, ETFs, SIP

When you start your investment journey, the first step may be challenging. As today’s new-age investors have a plethora of options to choose from, deciding on a suitable investment approach is crucial. In this regard, a Systematic Investment Plan (SIP) provides a simple, affordable and effective mode to invest in mutual funds and grow your wealth over time. In fact, with some astute planning and discipline, you can aim to achieve your financial goals by regularly investing something as nominal as ₹500 a month.

This article explains why an SIP with Mutual Fund may be suitable for new investors, its benefits, and how your investment can grow over time.

Why Choose SIP at ₹500?

Small investment, big potential

Even if you don’t have a high investing budget initially, you can start with something as affordable as ₹500 and aim to build your wealth over time. Since SIPs make investing accessible to all, there is little merit in waiting for years to save and then invest. Start small, start early!

Build an Investing Habit

SIPs help you develop regular investing habits. By contributing a fixed amount every month, week or day, you stay disciplined with your money, which is crucial for meeting long-term financial objectives.

Let Compounding Work Its Magic

Starting early has many benefits. Even small investments may grow into a substantial amount over time thanks to the power of compounding. The earlier you begin, the more time your money has to grow.

No Need to Time the Market

Worried about investing when the market is up or down? With SIPs, you don’t have to stress about timing the market. SIPs leverage the principle of rupee cost averaging, which means you buy more units when prices are low and fewer when prices are high, levelling out the overall cost of investment.

Flexibility to Suit Your Needs

Life is unpredictable, and your finances could be too. Most SIP plans let you adjust the amount you invest, making them flexible for different stages of your life. You can also pause, stop or top-up SIPs to suit your investing budget or change in financial goals.

Benefits of Investing ₹500 in a Monthly SIP

Affordability

To start an SIP, you don’t need a huge amount. With just ₹500, you can position yourself to potentially achieve your financial goals over a period of time.

Goal-Oriented Investing

SIPs can be tailored in accordance with the goals of an investor. While an SIP investment for some people could be for education, travel or emergencies, for others it could be for buying a house or building a retirement corpus.

Diversification

The best part about investing in ₹500 SIP plan is that it can give you access to a diversified and professionally managed investment product at a pocket-friendly amount. Diversification helps to spread and balance out the risks associated with any one asset class or sector.

Tax Benefits

SIPs in certain schemes, like Equity Linked Savings Schemes (ELSS), also allow tax deductions under Section 80C, under the old tax regime. This way investors can reduce their tax burden and harness the potential of equity investments if they have opted for the old regime.

Stress-Free Investing

Many investors may not have the time and expertise to constantly monitor the market and make suitable investments. However, by investing in ₹500 SIP, they can automate the investment process, making it convenient.

Estimated Growth of ₹500 Investment

Have you ever imagined how far can a ₹500 SIP take you in your financial journey? When the power of compounding blends with market growth, even a modest amount as low as ₹500 can potentially work wonders.

Using an SIP calculator , we can calculate how this modest investment can grow over different periods with an assumed annual return rate.

5 Years: Suppose you are investing Rs. 500 per month at an assumed annual return of 12% then this amount could compound to approximately ₹40,552*.

10 Years: The same SIP amount over the span of 10 years can potentially grow to ₹1,12,018 lakh at the same 12% assumed rate of return*.

20 Years: And if you show some more patience and invest this SIP amount for 20 years, it has the potential to build you a corpus of approximately ₹4,59,929 lakh*.

So, if you begin investing in ₹500 SIP, the compounding effect can significantly grow returns compared to traditional saving instruments. SIP investment for beginners leverages time as the most critical factor.

Factors To Consider Before Investing in Funds with ₹500

Your Risk Appetite

Understanding your risk tolerance is crucial. Ask yourself how much risk you are comfortable taking and narrow down your investment choices accordingly.

Investment Goal and Horizon

Be clear about your objective. If your goal is to grow your wealth steadily or meet long-term financial targets like retirement or children’s higher education, a ₹500 SIP might be the stepping stone. However, you may need to invest more or explore various investment schemes to meet different objectives.

Performance of the Scheme

Before choosing a scheme, review its past performance. While historical returns don’t guarantee future results, they may give you a sense of how the scheme has managed market ups and downs. Check if it aligns with your financial needs and expectations.

Expenses

Even with a ₹500 SIP, there may be expenses such as fund management fees or exit loads. High expenses could outweigh the benefits of low investment thresholds.

Mutual Fund schemes to Invest with ₹500 Minimum SIP

Debt Funds : These funds invest in fixed-income securities like bonds, treasury bills and debentures and aim to provide a relatively stable return potential with low market risk. Debt instruments prioritise preservation of capital and regular income generation.

Equity Funds: These funds invest in stocks of companies and aim for a higher return potential, but they are associated with a higher market risk. However, equities have the potential for generating inflation beating returns over the long-term.

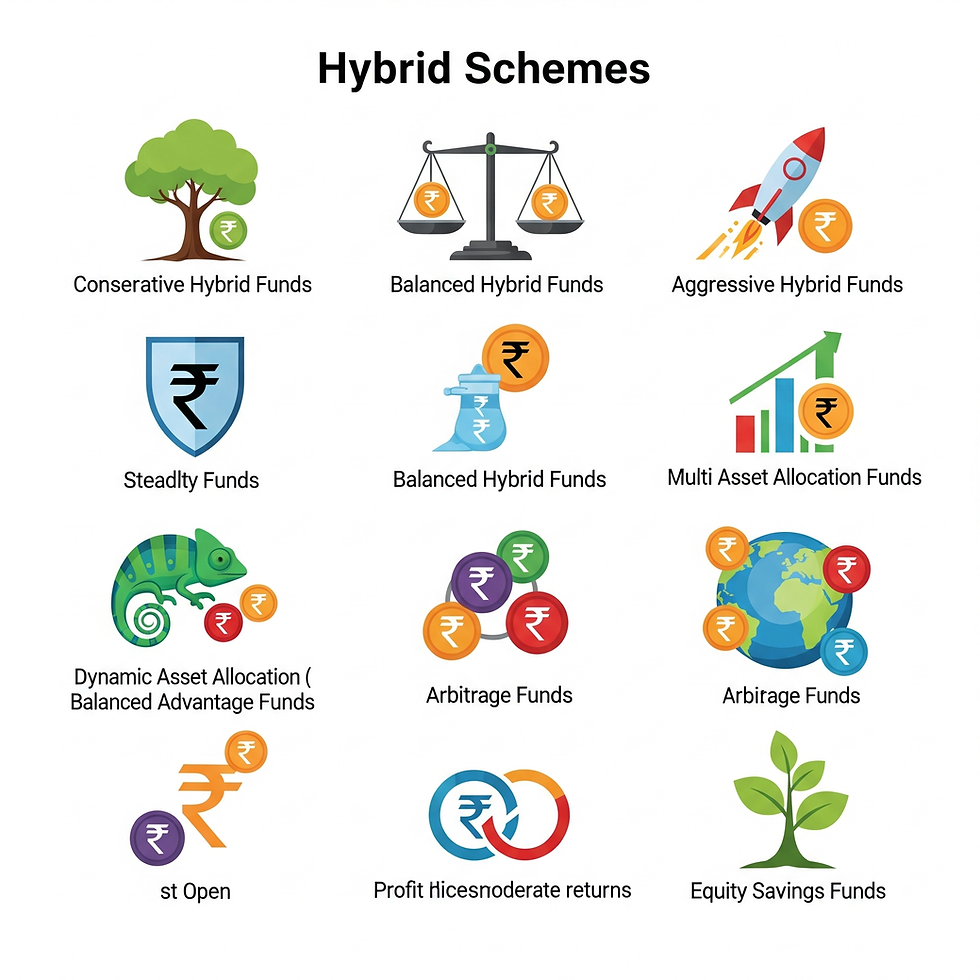

Hybrid Funds : Combine equity and debt investments to balance the risk/return profile. They can be suitable for investors who want to benefit from the growth potential of equities, but with a lower market risk compared to pure equity plans.

Sectoral & Thematic Funds: These funds target specific sectors or themes, such as technology or healthcare, aiming for higher growth potential, but with sectoral concentration risks.

ELSS Funds : Also known as Equity-Linked Saving Schemes (ELSS), these funds provide tax benefits under Section 80C, under the old tax regime, with diversified equity exposure and a three-year lock-in period.

Conclusion

₹500 to start an SIP may be pocket-friendly, and it gives you the potential to secure your financial future, affordably and conveniently. SIPs not only build a saving habit, but the power of compounding can also help you realise the full potential of your investment, setting you on the path to achieve financial goals such as education, house, travel or retirement. So, don’t wait any more and start investing ₹500 SIP today.

FAQs for SIP at ₹500:

What is the minimum amount to start a SIP ?

SIPs are affordable for all investors. A beginner can start investing in Mutual Fund SIPs with an amount as low as ₹500. An investor can also increase or decrease the SIP amount as per their evolving needs and financial situation

.

What are the advantages of a ₹500 Monthly SIP?

Besides building a disciplined saving habit, a ₹500 SIP leverages the power of compounding and rupee cost averaging. It also provides diversification benefits and access to the skills of professional money managers at a relatively low cost.

How to choose the best funds with ₹500 Monthly SIP before investing?

Understand your risk appetite, set your investment goals, research about the performance of the fund and the expenses attached to it. Seeking a financial expert’s consultation is advisable.

How to invest in mutual funds with a monthly ₹500 SIP?

You can start a SIP online or offline. Choose a fund, set up an account with UTI Mutual Fund, and provide the required details with OTM registration for automatic monthly contributions.

How much can ₹500 SIP grow in 10 years?

A ₹500 SIP can grow to approximately ₹1.12 lakh in 10 years, assuming an average annual return of 12%.* However, there is no guarantee of returns.

Can I change my SIP amount later?

SIPs are flexible and you can increase or decrease the investment amount based on your changing goals and financial situation.

How is ₹500 SIP beneficial for long-term goals?

A ₹500 SIP is a powerful tool for achieving long-term goals by fostering disciplined investing. Over time, the combination of regular contributions, compounding returns, rupee cost averaging, and market growth can help your investments grow significantly. It’s ideal for building a corpus to fund milestones like retirement, children’s education, or purchasing a home.

Who should look to invest in a Mutual Fund SIP of ₹500/month?

A ₹500 monthly Mutual Fund SIP is ideal for beginners with limited savings, such as students or young professionals. It can be suitable for individuals who want to develop disciplined investing habits, explore mutual funds with minimal risk, and gradually build wealth without straining their monthly budget or financial commitments.

Disclaimer:

The information set out above is included for general information purposes only and is not exhaustive and does not constitute legal or tax advice. All complaints regarding Mutual Fund can be directed towards visit www.scores.gov.in (SEBI SCORES portal). Readers are requested to make informed investment decisions and consult Chaitanya Financial Consultants – 9000628943 / mfd.mmr@gmail.com to determine the financial implications with respect to investing in Mutual Funds.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Join WhatsApp group for better and personalised communication regarding investment lessons, advice and help.

Note: Members of our WhatsApp group will enjoy lifetime free investment advice and will not be charged any consultation fee for mutual fund investments.

Support My Mission – Your Small Contribution Matters!

I am passionate about sharing financial knowledge and guiding people toward financial independence. Through my articles, I strive to provide valuable insights that can help you make smarter investment decisions and secure your future.

If my work has added value to your financial journey, I would truly appreciate your support. A small contribution from you—whatever amount you feel is right—will go a long way in motivating me to continue creating high-quality content.

💰 You can support me via:

✔ Paytm / Google Pay / Amazon Pay: 9000628943

✔ PayPal: manomatt@rediffmail.com

Every small payment is not just financial support—it’s an encouragement that fuels my passion for educating and empowering others. Thank you for being a part of this journey! 🙏

Here’s your chance to earn extra money effortlessly. Simply refer someone to invest in any mutual fund scheme, and as soon as they invest, you'll receive ₹100 - ₹200 instantly in your bank account via Paytm or PhonePay. Start referring and start earning today!

Comments