Short term needs versus Long Term Goals

- M Manohar Rao

- Jun 18, 2025

- 3 min read

Tags: Wealth Management, Investment Lesson, Mutual Funds, Mutual Fund Basics, Stock market, Budget, Finance, Investing, Personal Finance, Investment, ETFs, SIP, Multi cap

Take a relook at the examples at the previous posts. Shalini’s higher education is roughly ten years away, whereas Rabindra may work for another fifteen years. On the other hand, Surinder Singh may need to buy a house in the next couple of years. Mrs. D’Souza’s case is interesting since she has a need for income from investments in the immediate term, but the same must also continue for a long and uncertain period, as the income is required for life. Rabindra would also enter a similar situation on retirement.

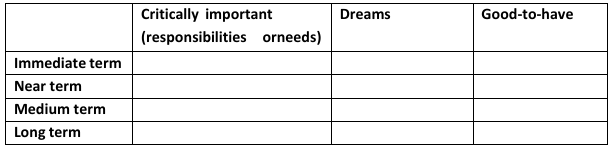

The retirement goal can be broken into two parts – accumulating a sum for retirement and then taking income out of the corpus thus accumulated. Another look at the two approaches to classify the goals indicates that the goals can be placed in the following matrix:

This looks very similar to the urgent v/s important matrix that Stephen Covey discussed in his bestseller “The Seven Habits of Highly Effective People”. The matrix is referred to in the context of time management, and it classifies various tasks one undertakes during the day, as well as over a period. Let us take a look at the matrix:

(Source: The Seven Habits of Highly Effective People, by Stephen R Covey)

In the book, Covey says that as long as you keep focusing on Quadrant I, it keeps getting bigger and bigger and then starts to dominate you. This quadrant referred to by Covey is “urgent and important”. When that happens, the ‘important but not-so-urgent’ tasks are not planned for in time until they also enter the quadrant 1, becoming urgent. The same principle applies to financial goals, too. A large number of people struggle with their finances since they do not plan for the important and not urgent events in life.

Wisdom suggests that if one plans well for those important and not urgent tasks (and goals), life changes for the better. In order to achieve this, it is important to first classify the financial goals – those events in life in terms of timeline and importance in one’s life.

Disclaimer:

The information set out above is included for general information purposes only and is not exhaustive and does not constitute legal or tax advice. All complaints regarding Mutual Fund can be directed towards visit www.scores.gov.in (SEBI SCORES portal). Readers are requested to make informed investment decisions and consult Chaitanya Financial Consultants – 9000628943 / mfd.mmr@gmail.com to determine the financial implications with respect to investing in Mutual Funds.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Join WhatsApp group for better and personalised communication regarding investment lessons, advice and help.

Note: Members of our WhatsApp group will enjoy lifetime free investment advice and will not be charged any consultation fee for mutual fund investments.

Support My Mission – Your Small Contribution Matters!

I am passionate about sharing financial knowledge and guiding people toward financial independence. Through my articles, I strive to provide valuable insights that can help you make smarter investment decisions and secure your future.

If my work has added value to your financial journey, I would truly appreciate your support. A small contribution from you—whatever amount you feel is right—will go a long way in motivating me to continue creating high-quality content.

💰 You can support me via:

✔ Paytm / Google Pay / Amazon Pay: 9000628943

✔ PayPal: manomatt@rediffmail.com

Every small payment is not just financial support—it’s an encouragement that fuels my passion for educating and empowering others. Thank you for being a part of this journey! 🙏

Here’s your chance to earn extra money effortlessly. Simply refer someone to invest in any mutual fund scheme, and as soon as they invest, you'll receive ₹100 - ₹200 instantly in your bank account via Paytm or PhonePay. Start referring and start earning today!

Comments