How Mutual Funds help in purchasing House or plot

- M Manohar Rao

- Feb 22, 2025

- 3 min read

Tags: Wealth Management, Investment Lesson, Mutual Funds, Stock market, Budget, Finance, Investing, Personal Finance, Investment

Mutual funds can be an effective tool to accumulate wealth for purchasing your own house or plot. Here’s how they can help:

1. Goal-Based Investing Strategy

Since buying a house or plot is a long-term financial goal, mutual funds can help you systematically build a corpus over time.

Allocate funds based on your goal: Debt funds for short-term safety ,equity funds for long-term growth

Monitor and rebalance your portfolio periodically to stay on track

2. Systematic Wealth Accumulation

Mutual funds, especially equity mutual funds, offer the potential for higher returns over the long term, helping you grow your investment faster than traditional saving accounts.

A well-planned Systematic Investment Plan (SIP) can help you accumulate a significant corpus over time.

3. Beating Inflation

Real estate prices tend to rise over time. Investing in mutual funds helps our money grow at a rate that typically outpaces inflation, ensuring that your savings maintain their purchasing power.

4. Choosing the Right Type of Mutual Funds

Short-Term Goal (1-3 years) → Invest in Debt Funds or Liquid Funds for stability ,lower risk and better returns than fixed deposits.

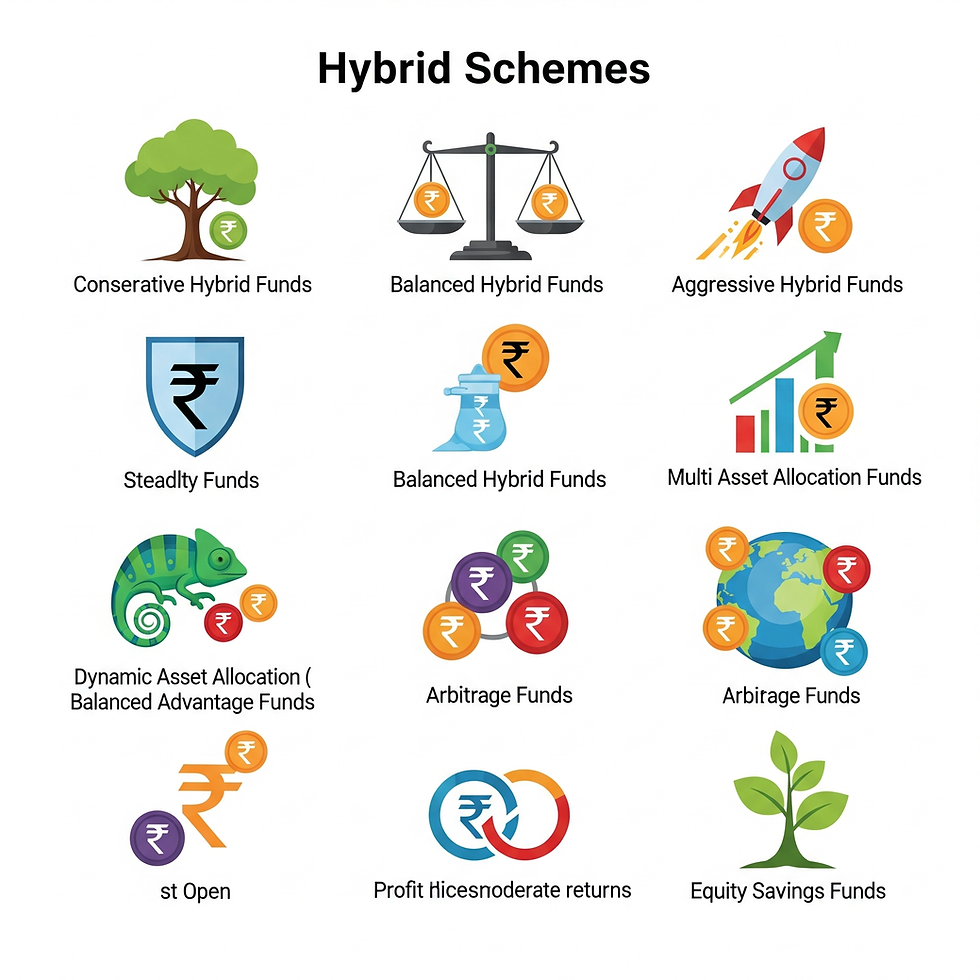

Medium-Term Goal (3-5 years) → Invest in a mix of Hybrid Funds (Balanced Advantage or Aggressive Hybrid) for moderate growth.

Long-Term Goal (5+ years) → Invest in Equity Mutual Funds (Large Cap, Flexi Cap, or ELSS for tax benefits) for higher returns.

5. Systematic Investment Plan (SIP) Approach

Investing a fixed amount regularly via SIP ensures disciplined savings and benefits from rupee cost averaging and compounding.

Example: A ₹10,000 monthly SIP in an equity fund with an average 12% annual return can grow to:

₹7.1 lakh in 3 years

₹21.5 lakh in 7 years

₹50 lakh+ in 12 years (enough for a down payment or even a full purchase in some cities).

You can plan a SIP in mutual funds to accumulate the down payment required for home loan.

Over time, the power of compounding ensures steady growth of your savings.

6. Lump Sum Investment for Faster Growth

If you have a lump sum amount (like a bonus), investing in a Systematic Transfer Plan(STP) from a liquid fund to an equity fund can enhance returns while managing risk

7. Systematic Withdrawal Plan (SWP) for Down Payment

When you’re ready to buy, you can gradually withdraw from mutual funds via SWP to reduce market risk.

8. Tax Benefits & Liquidity

Equity Linked Saving Schemes (ELSS )Funds provide tax benefits under Section 80C (₹1.5 lakh deduction), reducing your tax liability while helping you save

Debt Funds with indexation can reduce long-term capital gains tax.

Long-Term Capital Gains(LTCG) Tax on equity funds is lower than many other forms of investment, making them tax-efficient

Unlike real estate investments, mutual funds offer high liquidity, so you can sell units when needed.

9. Alternative: Mutual Funds vs. Home Loan

Instead of taking a high-interest home loan, accumulating wealth through mutual funds can help you buy with minimal or no loan, reducing financial burden.

If you still need a loan, your mutual fund corpus can help in reducing the loan amount and interest paid.

Conclusion

A well-structured mutual fund investment strategy can turn your dream of homeownership into reality in a financially efficient way. By making smart investment choices, you can systematically grow your wealth, reducing the need for excessive borrowing and high-interest costs. With disciplined investing, purchasing a house or plot becomes a well-planned, stress-free milestone rather than a financial burden.

Disclaimer:

The information set out above is included for general information purposes only and is not exhaustive and does not constitute legal or tax advice. All complaints regarding Mutual Fund can be directed towards visit www.scores.gov.in (SEBI SCORES portal). Readers are requested to make informed investment decisions and consult Chaitanya Financial Consultants – 9000628943 / mfd.mmr@gmail.com to determine the financial implications with respect to investing in Mutual Funds.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Join WhatsApp group for better and personalised communication regarding investment lessons, advice and help.

Comments