How an NRI living abroad can invest in Mutual Funds in India

- M Manohar Rao

- Feb 14, 2025

- 3 min read

Tags: Wealth Management, Investment Lesson, Mutual Funds, Stock market, Budget, Finance, Investing, Personal Finance, Investment

As an NRI (Non-Resident Indian) living abroad, you can invest in mutual funds in India, but there are some specific requirements and regulations you need to follow. Here’s a step-by-step guide:

Step 1: Understand NRI Investment Routes

NRIs can invest in Indian mutual funds through two routes:

Repatriable Basis – If you want to take your money back to your foreign country, invest through an NRE (Non-Resident External) account.

Non-Repatriable Basis – If you don’t intend to repatriate the investment proceeds, use an NRO (Non-Resident Ordinary) account.

Step 2: Open an NRI Bank Account

To invest, you must have one of these accounts with an Indian bank:

NRE Account – For repatriable investments

NRO Account – For non-repatriable investments

FCNR (Foreign Currency Non-Resident) Account – Not commonly used for mutual funds

Additionally, you need to get an FATCA (Foreign Account Tax Compliance Act) declaration if you are in the U.S. or Canada.

Step 3: Get a PAN Card

A Permanent Account Number (PAN) card is mandatory for investing in mutual funds in India. If you don’t have one, apply through the NSDL or UTIITSL website.

Step 4: Complete KYC Compliance

NRIs must complete Know Your Customer (KYC) verification by submitting:

PAN Card (self-attested copy)

Passport (self-attested copy)

Overseas Address Proof (utility bill, bank statement, or rental agreement)

Indian Address Proof (if available)

Passport-size Photograph

In-Person Verification (IPV) – Can be done through video KYC or at designated branches.

KYC forms can be downloaded from CAMS, KFintech, or mutual fund company websites.

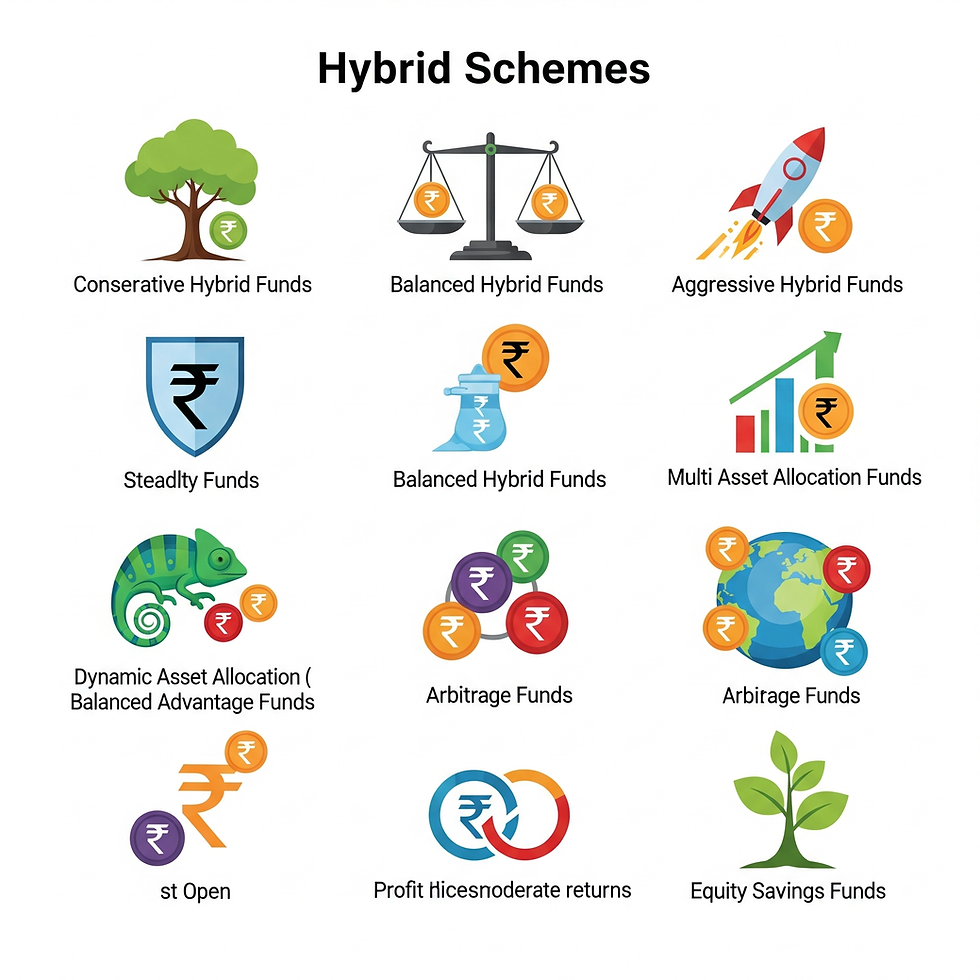

Step 5: Choose Mutual Fund Schemes

You can invest in:

Equity Mutual Funds – For long-term growth

Debt Mutual Funds – For stability and lower risk

Hybrid Funds – A mix of equity and debt

Index Funds / ETFs – Passive investing options

Consider factors like risk appetite, investment goals, and tax implications.

Step 6: Invest Through Online or Offline Mode

Directly through AMC Websites – Most mutual fund houses allow online investment.

Through a Mutual Fund Distributor or RIA – Helps in fund selection and paperwork.

Using NRE/NRO Accounts – Invest via net banking, UPI, or wire transfer.

Through Apps & Platforms – Groww, Zerodha Coin, MF Utility, and other fintech platforms support NRI investments.

Step 7: Understand Taxation for NRIs

Short-Term Capital Gains (STCG)

Equity Funds (<12 months) – 15% tax

Debt Funds (<36 months) – Tax as per your income tax slab

Long-Term Capital Gains (LTCG)

Equity Funds (>12 months) – 10% tax on gains exceeding ₹1 lakh

Debt Funds (>36 months) – 20% tax with indexation benefits

TDS (Tax Deducted at Source) –

Equity MF: No TDS

Debt MF: 30% (STCG), 20% (LTCG with indexation)

NRIs from countries with DTAA (Double Taxation Avoidance Agreement) can claim tax relief.

Restrictions for NRIs from the USA & Canada

Some AMCs don’t allow investments due to FATCA compliance.

AMCs that allow investments: SBI MF, UTI MF, L&T MF, ICICI Prudential, Nippon India, and Aditya Birla Sun Life MF.

Investments might need physical forms instead of online modes.

Conclusion

Investing in Indian mutual funds as an NRI is easy if you complete the required formalities. Make sure to choose the right account, complete KYC, and consider tax implications before investing.

Disclaimer:

The information set out above is included for general information purposes only and is not exhaustive and does not constitute legal or tax advice. All complaints regarding Mutual Fund can be directed towards visit www.scores.gov.in (SEBI SCORES portal). Readers are requested to make informed investment decisions and consult Chaitanya Financial Consultants – 9000628943 / mfd.mmr@gmail.com to determine the financial implications with respect to investing in Mutual Funds.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Comments