Chaos is a ladder: 2025 Outlook

- M Manohar Rao

- Feb 3, 2025

- 8 min read

Tags: Wealth Management, Investment Lesson, Mutual Funds, Stock market, Budget, Finance, Investing, Personal Finance, Investment

Last year, i.e. 2024 was called the ‘The year of regime shift(s)’.

We expected major global central banks to initiate monetary easing after the aggressive hiking cycles of 2022 and 2023. We also opined that political shifts might necessitate a change in investment frameworks with administration shifts in major economies impacting growth and inflation dynamics. We also expected the usually strong but leverage-driven Indian consumption to hit a brick wall and slow down.

We enter 2025 with major political shifts happening across Europe and the US.

Seventy-seven elections were held across the globe with Mexico and India being the only exceptions amongst the major economies where incumbents held on to power. While global growth is expected to remain stable, the result of the US election has stoked uncertainties regarding the economic outlook. The potential tightening of immigration policies and tariff hikes along with tax cuts and business deregulation present a complex cocktail of adverse supply and favourable demand shocks. The change in the US administration has re-introduced uncertainty into the equation.

There is an old saying that markets hate uncertainty.

We usually prefer giving premiums to predictable and stable entities because we think we can predict their reaction function. We clamour for forward guidance from central banks. We also assume cause-and-effect works linearly in markets, i.e. a certain outcome will follow a certain playbook. For example, we expect bond yields to go down when the central bank cuts rates.

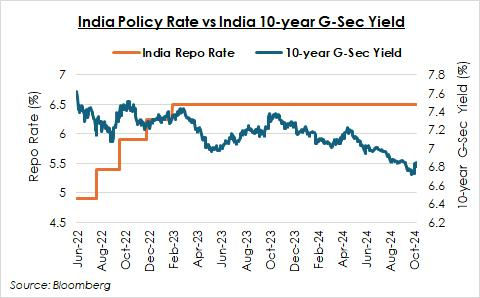

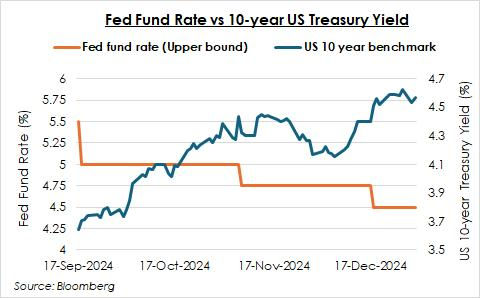

The following chart represents policy rates and 10-year sovereign benchmark yields for the US and India in the ‘easing cycle’ and ‘withdrawal of accommodation cycle’, respectively.

If somebody had held a crystal ball to the Federal Reserve’s September 2024 policy outcome and predicted a 50bps rate cut, participants might have preferred adding duration. However, as can be seen from the chart below, the US 10-year benchmark yield has gone up by 87bps since the 50bps cut by the Fed. On the other hand, the Indian 10-year benchmark has declined 80bps from its high despite a 160bps rate hike by RBI before it turned “neutral” in October 2024.

See the chart below for more details:

As seen above, markets can often behave unpredictably. We can only operate probabilistically, without certainty. The market reacts to changes in uncertainty, all other things being equal, with higher volatility (chaos).

Currently, the regime change in the US has become the starting point for 2025. Market participants are forecasting a highly uncertain year.

Even the Fed Chair remarked: “It’s kind of common sense thinking that when the path is uncertain you go a little bit slower… It’s not unlike driving on a foggy night or walking into a dark room full of furniture. You just slow down.”

We believe that investors should reflect on the following aspects while considering their investment decisions:

1) US administrative policies may not create durable inflation. A saturated labour market may blunt the impact of tighter immigration; tax benefits/business deregulation create pricing buffers

2) Global business cycle still calls for monetary easing

3) Indian growth cycle is facing slowdown; this is favourable for fixed income

4) Direct impact of US policies not material for Indian current accounts/inflation

The risks of US policies are two-sided

Most of the concerns come from a place of fear. However, we believe the impact of US policies, if implemented, should not be considered in singularity but in aggregation. The actual impact could be two-sided.

The potential demand destruction caused by tariffs and retaliatory trade policy responses against the US could exert disinflationary pressure on the rest of the world, as observed during the previous Trump administration. This, in turn, may allow global central banks to maintain stimulative policies. Additionally, the extension of tax cuts combined with business deregulation could provide pricing buffers for US industries, helping to mitigate the partial impact of tariffs domestically and potentially preventing durable inflation. Notably, the Federal Reserve is likely to treat tax impacts as one-offs, provided they do not significantly influence long term inflation expectations.

The impact of restrictions on immigration may be less impactful than expected as US labour demand is currently saturated with firms digesting recent hiring and many recently arrived migrants still entering the workforce.

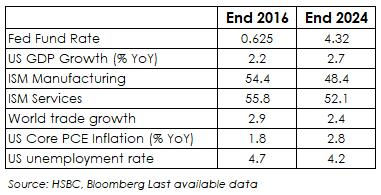

As we can see from the table below, the US was in a lower inflationary environment in 2016 compared to 2024. Given that the new administration has campaigned on a plank of lower inflation as well, sensitivity towards the inflationary impact of new measures is likely to be higher.

The global business cycle favours a soft landing

While government policies are important, they aren’t the only thing that matters.

Over the past two years, the global economy has shown resilience despite the most aggressive global rate hike cycle in 40 years. Global services have remained firmly in expansion, offsetting the post-Pandemic normalisation in manufacturing. The labour-intensive service sector has helped drive a virtuous cycle of tight labour markets and strong wages, which has been fed back into additional spending. China is promising a looser monetary and fiscal policy to offset any US trade actions and lift mainland growth, particularly consumption. Hence, barring a series of knee-jerk tariff hikes or exceptional situations, we still expect a global soft landing.

On the other hand, inflation has continued to gradually come down, as the lingering displacements from the Pandemic have abated and the effects of previous rate hikes have played through. Both core and headline global inflation have continued to trend toward their pre-Pandemic paces near 2%. While some central banks that are significantly exposed to US trade policies may wait for actual action on the ground before easing, largely the theme of global monetary easing is still intact.

The Indian context

Macro cycle: Favourable for fixed income

India’s robust growth of 8%+ between FY2022-2024 was largely a cyclical post-Pandemic rebound. This was fueled by pent-up urban consumption, a strong retail credit push from banks, the wealth effect from buoyant stock and real estate markets, positive terms of trade for corporates and aggressive public capex by the Government.

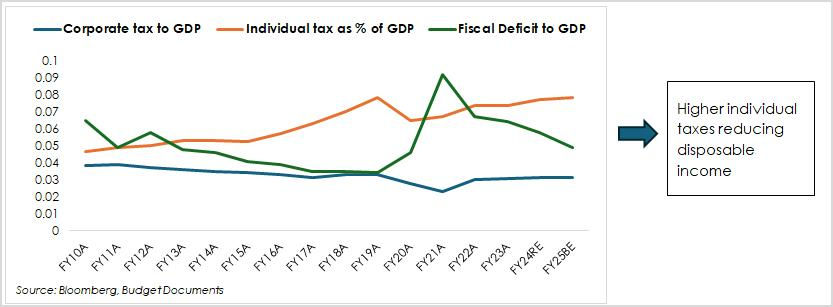

Looking ahead, we expect Indian growth to remain moderate. Consumption constituting nearly 55% of GDP, faces headwinds from lower disposable incomes (chart below) and weaker private sector wage growth amidst an already bloated household leverage.

The private sector’s favourable terms of trade are likely to wear out. The private sector capex is also expected to remain anaemic due to a challenging global environment, softer domestic demand and rising imports from China. Since the Government is undergoing a fiscal consolidation, the current capex may continue but may not have an outsized growth.

Impact of US policies on Indian growth and inflation: Minimal over long term

Under the previous Trump administration, India was removed from the Generalized System of Preferences (given to EM countries) and tariffs were imposed on certain sectors like steel and aluminum. However, it had a marginal impact on India’s exports.

While India today runs a substantial goods trade surplus with the US ($37Bn), across-the-board tariff hikes may not impact India’s export outlook materially as India’s competitiveness vis-a-vis other economies may remain stable. INR, nonetheless, may face a competitive devaluation risk with other EMs if the US imposes tariffs in a knee-jerk fashion.

However, as can be seen from the table below, while India saw meaningful currency pressure in 2018-2019 during the imposition of US tariffs, it did not have a material impact on growth or inflation. The slowdown in growth in 2019 was on account of shadow banking issues rather than tariffs. Moreover, 60% of India’s dependence on the US is related to the services sector (Source: Standard Chartered), which may marginally benefit from a weaker currency. Additionally, Trump’s deregulation agenda – especially in the energy space – may be constructive for net energy importers like India.

The tariff impact on India’s inflation is likely play out via a weaker INR. Given the stable core inflation, India’s inflation outlook will largely depend on the exchange rate trajectory and food inflation.

According to the Reserve Bank of India (RBI), a 5% weakening in the INR versus the USD could add 20 bps to headline inflation

While sustained INR depreciation may lead to near-term inflation, it could be offset by the deflationary pressure on imported goods as major exporters like China re-route their global supply. After averaging 8.5% for the last 12 months (Source: Bloomberg), we expect food inflation to moderate as the weather-related disruptions smoothen out.

Fixed-income outlook: Keep an open mind and stay focused on fundamentals

“Chaos is inherent in all compounded things. Strive on with diligence.”

‐ Gautam Buddha

Hope may be stronger than fear, but neither constitutes a sound investment strategy. If everything were certain and devoid of risk, there would be a very low probability of outperformance from the risk-free rate. It is uncertainty – and the volatility which makes improving our return profile more conceivable.

The next few months of 2025 are likely to be beset with volatility as markets react to announcements of trade, immigration or tax policies. Global financial conditions and currency markets may remain volatile in the near term. In extreme cases, disruptive policies could lead markets to price out any rate cuts in the foreseeable future.

Despite this unpredictability, what matters for asset prices is the economic cycle. Hence, investors with an open mind and a focus on economic fundamentals can derive larger benefits. In fact, any increase in volatility and correction in bond yields can present opportunities for investors to elongate their duration.

The Indian growth cycle looks challenging, with risks skewed to the downside. Domestic inflation is in a course-correction mode with weather-related food inflation shocks expected to subside.

While it may appear that RBI has been resisting cutting rates, it has been on an easing path since October. Despite the announcement of Chinese stimulus measures in September 2024 and heightened geo-political tensions in the Middle East, the RBI changed its policy stance to “neutral” from “withdrawal of accommodation” in October 2024. This ensured RBI had the flexibility to act on rates and liquidity.

In December 2024, the RBI cut the CRR by 50bps to inject durable liquidity into the system. Given the withdrawal of liquidity stemming from FX intervention, we expect RBI to provide further liquidity measures like FX Swaps and Bond Buybacks.

Additionally, slowing credit growth should obviate the need for aggressive growth on deposits, reducing pressure on the short to medium end of the yield curve.

Barring an exceptional economic shock, we expect the RBI to cut rates by 50-75bps in this cycle. From a valuation perspective, the short to medium end (0-4 years) of the corporate bond curve looks attractive from the accrual perspective. Once the rate cut cycle starts, this segment can benefit greatly from the possible mark-to-market gains, given the attractive spread over policy rates.

To conclude, chaos or volatility is not just a challenge but an opportunity to position portfolio strategy with focus on long term evolution of the economic cycle.

Disclaimer:

The information set out above is included for general information purposes only and is not exhaustive and does not constitute legal or tax advice. All complaints regarding Mutual Fund can be directed towards visit www.scores.gov.in (SEBI SCORES portal). Readers are requested to make informed investment decisions and consult Chaitanya Financial Consultants – 9000628943 / mfd.mmr@gmail.com to determine the financial implications with respect to investing in Mutual Funds.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Comments